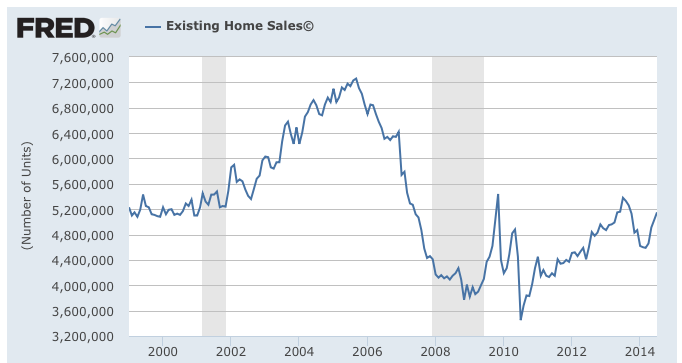

As you can tell from the graph Average Wage Growth has been muted at 2.0% and Real Median Household Income has went down from $56,000 USD to $52,000 USD from 2009 to 2014, a roughly 7% drop. Furthermore, employment as a function of population (a ratio) has went down meaning the unemployment rate is a lot higher than it seems or rather the baby boomers are retiring resulting in a higher proportion (lower rate) of people employed as a percentage of population. These 3 dynamics coupled with a real estate bust that saw prices drop considerably (but now that are picking up and have stabilized) has resulted in a muted real estate market in terms of Mortgage Purchase Application Index, Mortgages being taken out by people and homes being bought.

Rate the above article